Welcome to Grupo Spurrier

Grupo Spurrier is the leading company in the provision of strategic information on economic and political issues regarding Ecuador, which we monitor through Weekly Analysis and Análisis Semanal. We specialize in economic research, competition advice, market research, business plans, and workshops in economic scenarios and regulatory changes.

Weekly Analysis Briefs

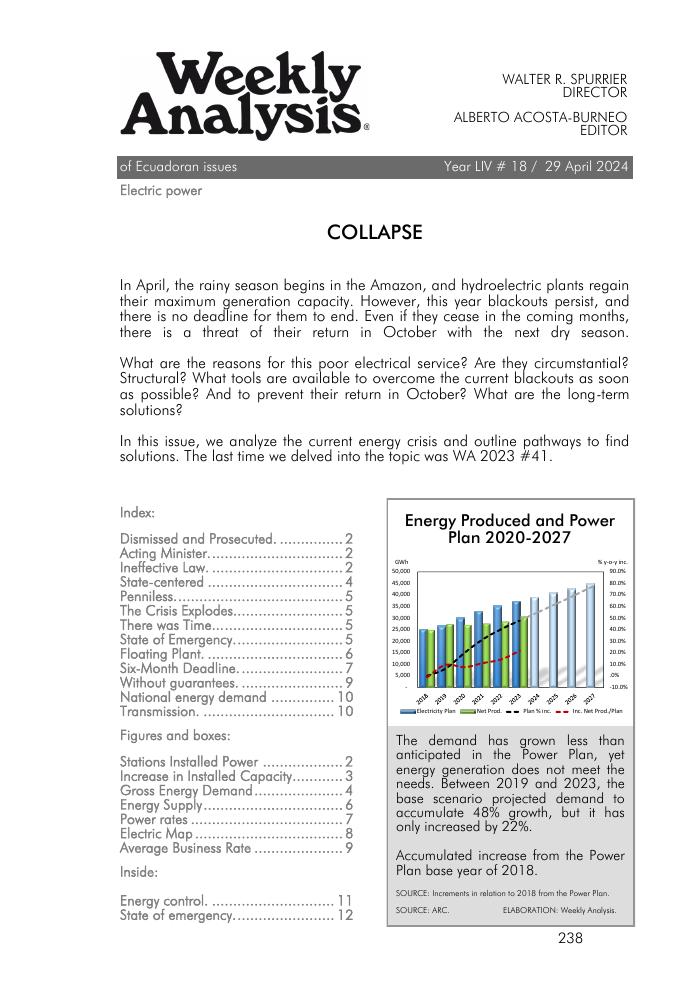

WA-2024-18: COLLAPSE

In April, the rainy season begins in the Amazon, and hydroelectric plants regain their maximum generation capacity. However, this year blackouts persist, and there is no deadline for them to end. Even if they cease in the coming months, there is a threat of their return in October with the next dry season. What are the reasons for this poor electrical service? Are they circumstantial? Structural? What tools are available to overcome the current blackouts as soon as possible? And to prevent their return in October? What are the long-term solutions? In this issue, we analyze the current energy crisis and outline pathways to find solutions. The last time we delved into the topic was WA 2023 #41.

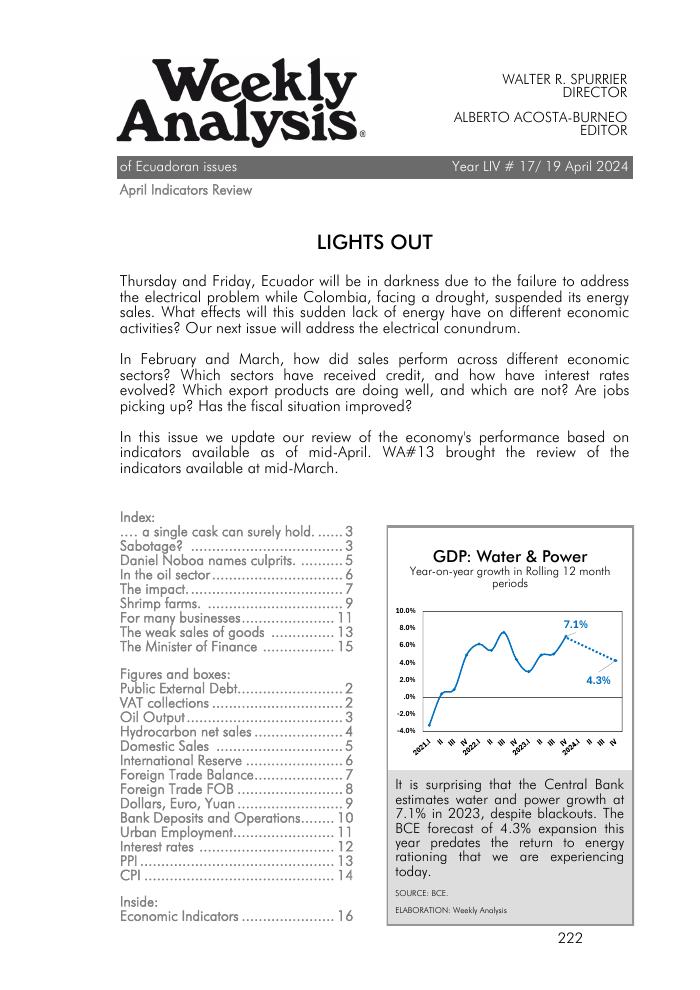

WA-2024-17: LIGHTS OUT

Thursday and Friday, Ecuador will be in darkness due to the failure to address the electrical problem while Colombia, facing a drought, suspended its energy sales. What effects will this sudden lack of energy have on different economic activities? Our next issue will address the electrical conundrum. In February and March, how did sales perform across different economic sectors? Which sectors have received credit, and how have interest rates evolved? Which export products are doing well, and which are not? Are jobs picking up? Has the fiscal situation improved? In this issue we update our review of the economy's performance based on indicators available as of mid-April. WA#13 brought the review of the indicators available at mid-March.

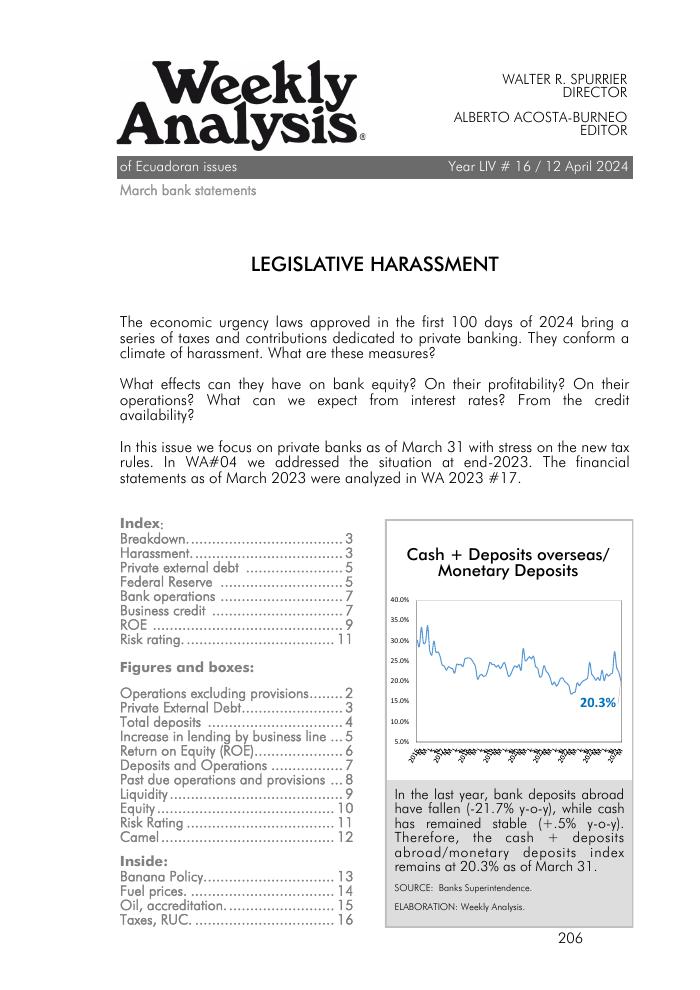

WA-2024-16: LEGISLATIVE HARASSMENT

The economic urgency laws approved in the first 100 days of 2024 bring a series of taxes and contributions dedicated to private banking. They conform a climate of harassment. What are these measures? What effects can they have on bank equity? On their profitability? On their operations? What can we expect from interest rates? From the credit availability? In this issue we focus on private banks as of March 31 with stress on the new tax rules. In WA#04 we addressed the situation at end-2023. The financial statements as of March 2023 were analyzed in WA 2023 #17.

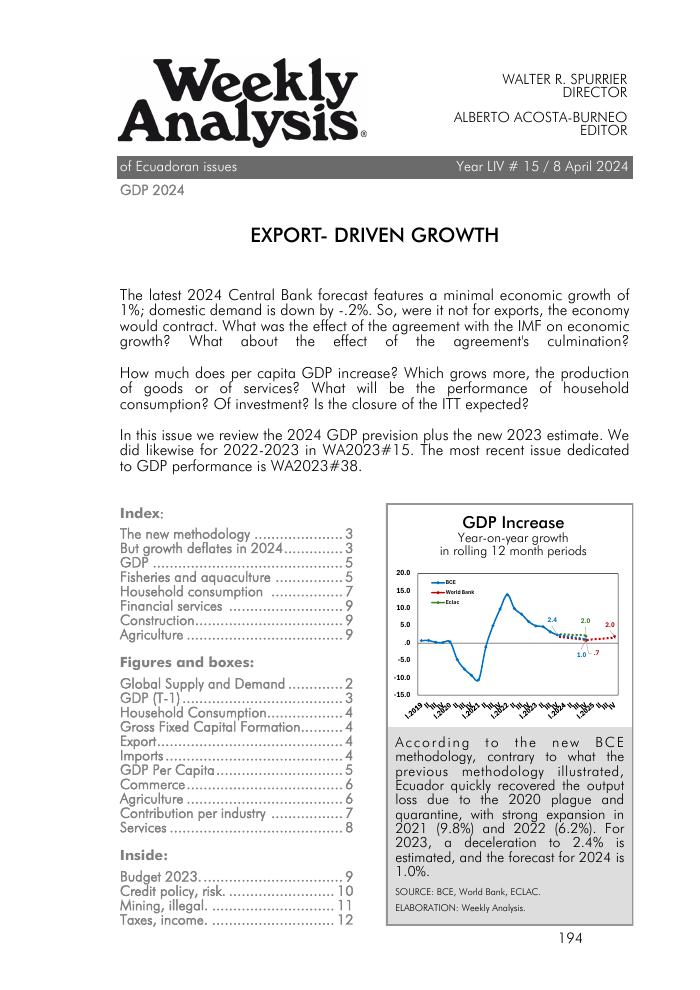

WA-2024-15: EXPORT- DRIVEN GROWTH

The latest 2024 Central Bank forecast features a minimal economic growth of 1%; domestic demand is down by -.2%. So, were it not for exports, the economy would contract. What was the effect of the agreement with the IMF on economic growth? What about the effect of the agreement's culmination? How much does per capita GDP increase? Which grows more, the production of goods or of services? What will be the performance of household consumption? Of investment? Is the closure of the ITT expected? In this issue we review the 2024 GDP prevision plus the new 2023 estimate. We did likewise for 2022-2023 in WA2023#15. The most recent issue dedicated to GDP performance is WA2023#38.

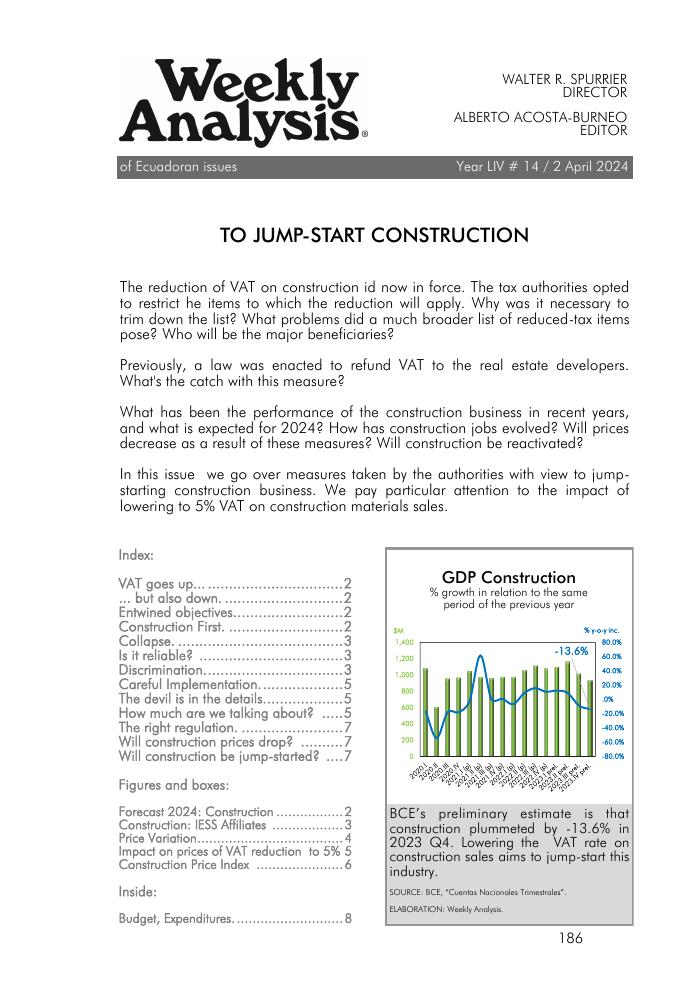

WA-2024-14: TO JUMP-START CONSTRUCTION

The reduction of VAT on construction id now in force. The tax authorities opted to restrict he items to which the reduction will apply. Why was it necessary to trim down the list? What problems did a much broader list of reduced-tax items pose? Who will be the major beneficiaries? Previously, a law was enacted to refund VAT to the real estate developers. What's the catch with this measure? What has been the performance of the construction business in recent years, and what is expected for 2024? How has construction jobs evolved? Will prices decrease as a result of these measures? Will construction be reactivated? In this issue we go over measures taken by the authorities with view to jump-starting construction business. We pay particular attention to the impact of lowering to 5% VAT on construction materials sales.

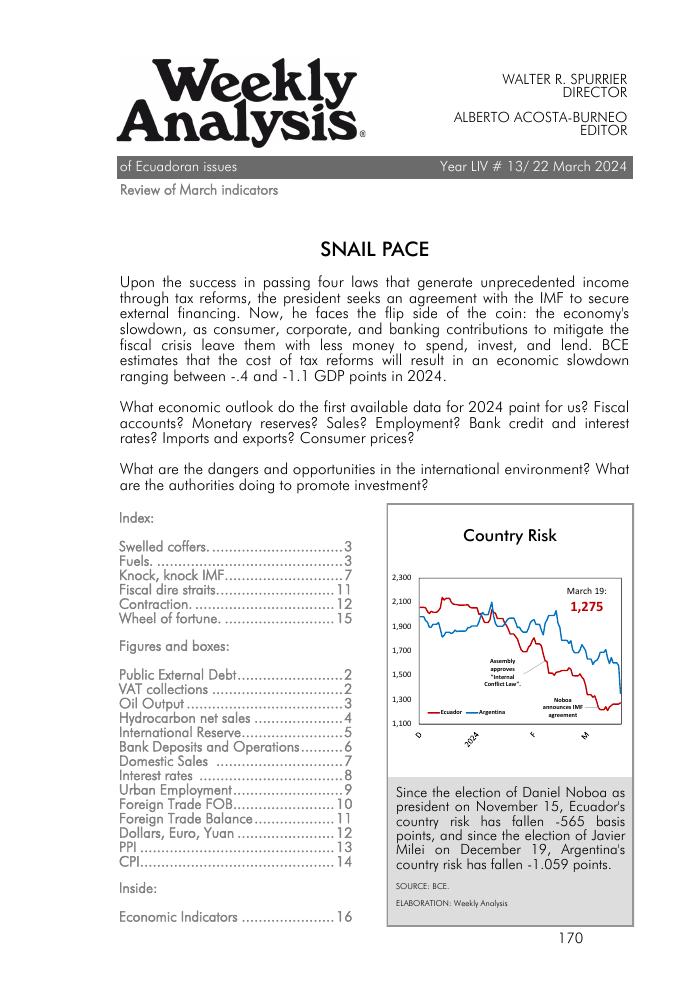

WA-2024-13: SNAIL PACE

Upon the success in passing four laws that generate unprecedented income through tax reforms, the president seeks an agreement with the IMF to secure external financing. Now, he faces the flip side of the coin: the economy's slowdown, as consumer, corporate, and banking contributions to mitigate the fiscal crisis leave them with less money to spend, invest, and lend. BCE estimates that the cost of tax reforms will result in an economic slowdown ranging between -.4 and -1.1 GDP points in 2024. What economic outlook do the first available data for 2024 paint for us? Fiscal accounts? Monetary reserves? Sales? Employment? Bank credit and interest rates? Imports and exports? Consumer prices? What are the dangers and opportunities in the international environment? What are the authorities doing to promote investment?